Frequently worth included financiers target these kinds of buildings as financial investments given that well-located class B structures can be gone back to their A class glory. These are the most steady residential or commercial properties. As an industrial investor, your objective is to find a B class building in an A class community and after that refurbish that developing to get A class leas. Class C is the most affordable main category and the structures are older and require updating. They have the least expensive rents and you'll discover lower to middle income renters in them. If you are an apartment investor, class C is the way to go because the ratio between the cost per unit and the rents are still great and you can get the greatest returns.

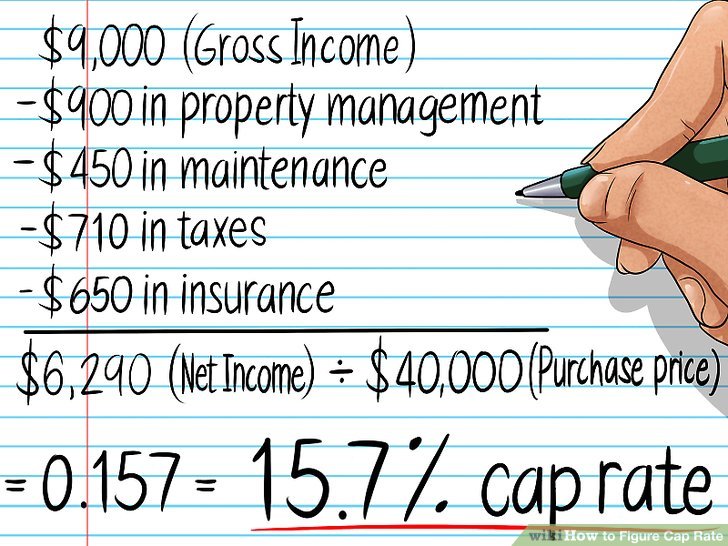

However, you require to be cautious because the buildings tend to require a lot of upkeep and the neighborhoods and tenants might be challenging. Managing these properties requires ability. There is also another class however it is not a main class. The buildings are often uninhabited and in requirement of extensive remodelling. Class D properties are for experts who have deep pockets. If you're a novice, do not even consider a class D building. Leases are the lifeline, they're the life blood of a business residential or commercial property keeping the cash streaming, therefore safeguarding you from foreclosure. They are legally binding composed agreements between the homeowner and renter. What is cap rate in real estate.

In a previous blog site, I discussed it in fantastic information. For apartment buildings the lease could be a one year lease, a 9-month lease or a month to month lease. All our leases are strong leases composed by our attorney. Why are they strong? Since you remain in the earnings organization. Leases offer you the legal right to collect rent, kick out people and take them to court if they do not pay. If you don't have a strong legal instrument your tenants can benefit from you and remain in your homes without paying rent. So, having a strong lease is actually important.

The occupant spends for whatever. This is a passive choice, where the property owner just has to pay the home loan. View my video Truth Behind Triple Internet Lease to discover more.: The occupant and landlord divided specific expenses. Again, leases are the lifeblood of any commercial realty financial investment. Another way to take a look at it is, you're buying the building for free and you're spending for the leases. The building deserves nothing without the leases. I have a reward term I desire to share with you and it is probably the most important regard to all if you wish to have long-term success as a business real estate financier.

Encourage the seller to work with you rather of others. Assist you deal with their broker that will send you his/her off market offers. The reward term is relationships. Business realty is a relationship based service. This is probably the most essential regard to them all due to the fact that if you don't get this part right, none of the other 7 terms matter. Here's the concern (How does a real estate agent get paid). What do you think will get you the very best deals, understanding terms or knowing individuals? What will encourage a seller to deal with you rather of others, is not knowing terms but understanding the needs, inspirations and developing relationship of the seller.

Things about How To Get A Real Estate License In Oregon

Study the terms and understand them, but I desire you to begin with relationships first. Commercial real estate is a relationship based service. I desire you to develop relationships with brokers, sellers, mentors, and other successful people. That's where success takes place first.

There is a variation of residential or commercial property turning and development of business realty, which is also described as. A merchant home builder is a developer that specializes in developing structures for near-term resale. For example, let's suppose a developer has a relationship with an industrial user that needs a 100,000 square-foot commercial structure. Before beginning construction, the developer indications a long-lasting lease with that company. The developer finds the land, gets the privileges, zoning approvals, gets his structure permit, gets his funding, and awards the building and construction to a contractor who builds the building, and now it's all shiny and new, and it's totally leased.

Very typically, a merchant developer chooses to sell instantly, within as low as a year after opening the building. That way, they remove their risk of holding long term, and they may recognize an immediate revenue. Nevertheless, that's not something that we like to do. We like long term holds, which our company believe is the method to develop long term value. If you go back to my very first major advancement in New York (Tower 45), our overall task cost was $140 million. At the time we completed the building (1990 ), the financial markets had nearly collapsed and we thought that the cost of the building was such that we would never be successful with the residential or commercial property.

Keep in mind that you're developing a structure from the ground up. There requires to be a lot of enjoyment produced around Find out more the structure to drive sales/leases. While it's under building, it's not yet on the radar of a lot of brokers up until it gets closer to opening, which's because brokers wish to make money by participating in a lease that they can gather a commission on. If the building is just a raw piece of land, it's usually viewed by the realty world as being somewhat far off and not as interesting a location to bring clients to right now.

The amount of energy and effort that enters into marketing a brand-new development project is substantially higher than it is with respect to an existing structure. It requires an extreme amount of knocking on doors and an awareness campaign, letting people know where you are timeshare vacations promotions on building and construction, when the building will be prepared, in addition to revealing interesting developments like recently signed leases. If the project is a workplace building, an exciting new occupant like Google or Apple would be an attractive occupant that may attract other occupants to the building. When it comes to a retail home, the anchor renter might be the essential occupant that draws other retail occupants to the shopping mall.

Some Known Incorrect get more info Statements About How To Be A Successful Real Estate Agent

You desire to keep the news fresh and moving and you wish to keep it in the eyes of the genuine estate broker. Practically every week, some type of relevant occasion ought to be reported and promoted. The general expense of marketing and the basic push for a structure that's being developed requirements to be multiples higher than what it is for an existing building. Let's expect you developed a brand-new structure, however for some factor, you did not get a great deal of long term leases from the initial lease-up. It would be a mistake to attempt to sell that building with a fairly unsteady rent roll.